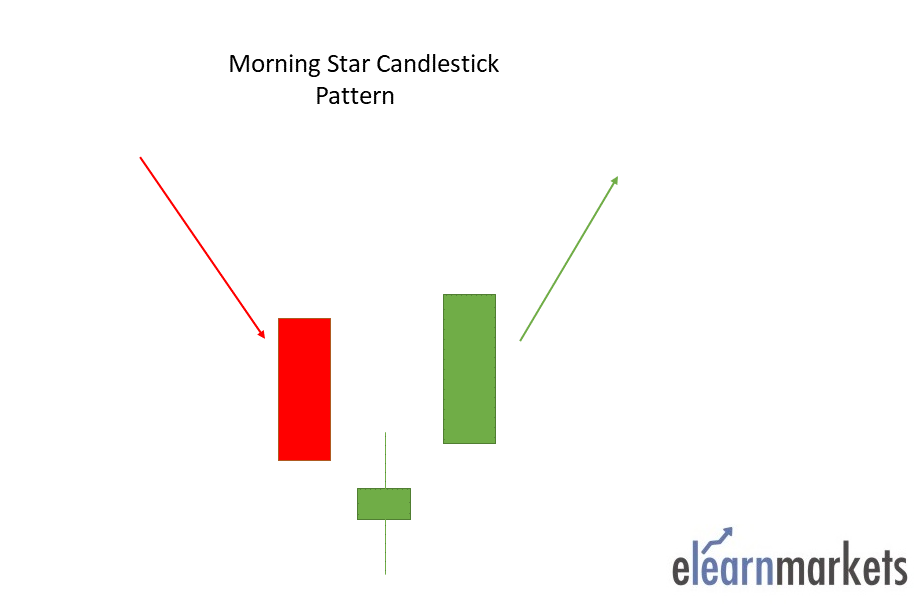

4. The Morning Star:

The Morning Star is a multiple candlestick chart pattern which is formed after a downtrend indicating a bullish reversal.

It is made of 3 candlesticks, the first being a bearish candle, the second a Doji and the third being a bullish candle.

The first candle shows the continuation of the downtrend. The second candle being a doji indicates indecision in the market. The third bullish candle shows that the bulls are back in the market and reversal will take place.

The second candle should be completely out of the real bodies of the first and third candles.

Traders can enter a long position if the next day a bullish candle is formed and can place a stop-loss at the low of the second candle.

Below is an example of Morning Star Candlestick Charts Pattern: