Bullish Harami: candle pattern is a reversal pattern appearing at the bottom of a downtrend. It consists of a bearish candle with a large body, followed by a bullish candle with a small body enclosed within the body of the prior candle. As a sign of changing momentum, the small bullish candle ‘gaps’ up to open near the mid-range of the previous candle.

The opposite of the Bullish Harami is the Bearish Harami and is found at the top of an uptrend.

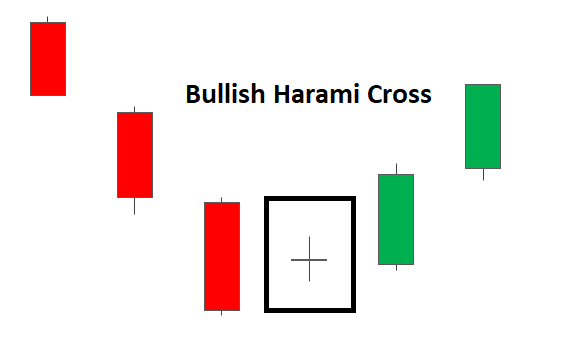

The Bullish Harami Cross

Traders will often look for the second candle in the pattern to be a Doji. The reason for this is that the Doji shows indecision in the market. The colour of the Doji candle (black, green, red) is not of too much importance because the Doji itself, appearing near the bottom of a downtrend, provides the bullish signal. The Bullish Harami Cross also provides an attractive risk to reward potential as the bullish move (once confirmed) is only just starting.

No comments:

Post a Comment